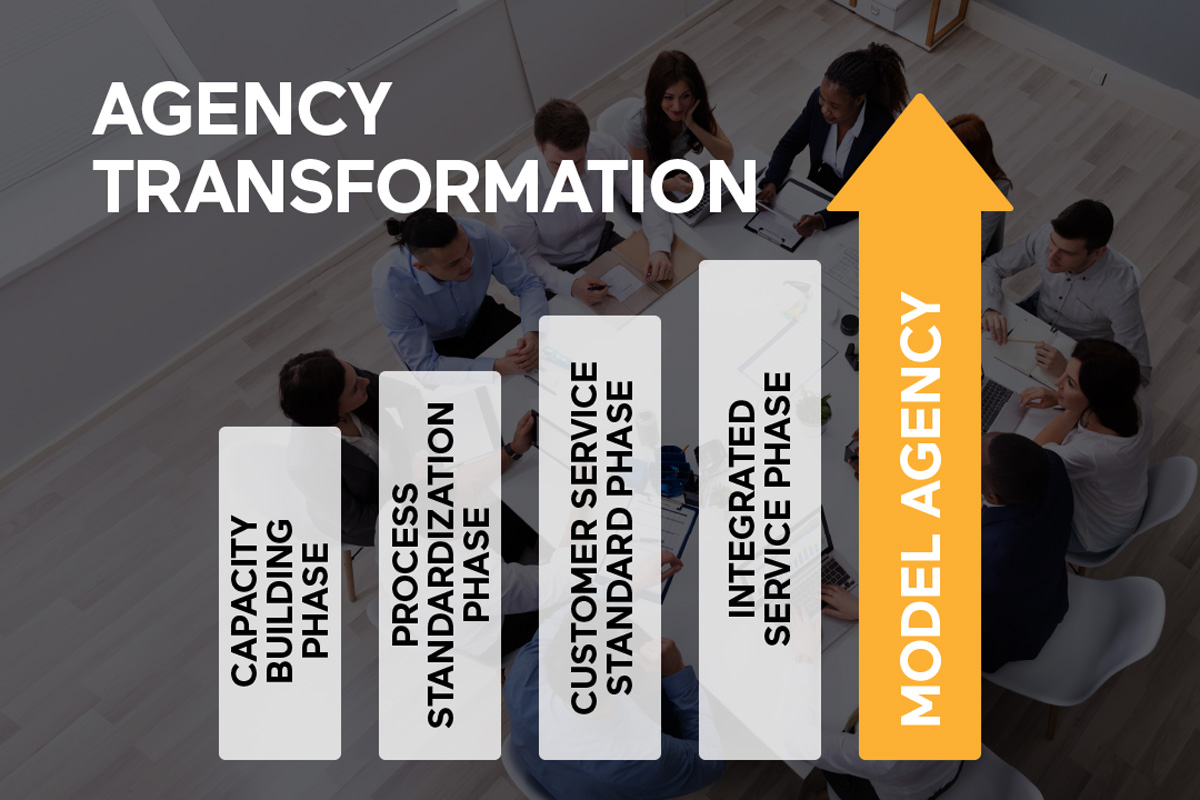

After Phase 4, your agency is functioning better than seemed possible at the start of the Agency Transformation journey. But you haven’t yet reached a state of continuous improvement. Now it’s time to become a Model Agency—an agency that others can reference as they pursue their own modernization efforts.

Here your agency adds tools of operational excellence that can measure performance, identify and resolve process exceptions, and demonstrate value to stakeholders.

Agencies using a regulatory software solution like GL Suite can add this analytics layer to the platform they built over the previous phases, giving them automatic data collection and insights. Other advanced functions like batch processing come online and continue improving during this phase.

How it looks: With a truly integrated system and seamless digital-first workflows in place, your agency implements GL Suite’s analytics layer, gaining real-time insights that power continuous improvement in permitting and licensing processes. In time, you become a model for other government regulatory agencies to emulate.